Hi Playmakers,

By now, you’ve all survived Black Friday madness and are getting ready for the holidays. But this year, you might’ve noticed something different.

I’ve shared over multiple past newsletters about the economic fragility that is directly under the surface if you take the time to look. I’ve got a hot take at the end of this letter that’ll surely ruffle some feathers. Let’s dive in…

The headlines are already shouting it from the rooftops:

“Americans spend a record $11.8 billion online during Black Friday!”

“The United States is back on top, baby!

“Americans don’t know what to do with all that extra cash!”

Of course, anyone who hasn’t been firmly wedged under a rock knows we’re living in a K-shaped economy. The wealthy are doing just fine, but the middle and lower classes are finding it increasingly difficult to get by. The proof is obvious once you look past the headlines…

Adjusting for Inflation

Retail sales climbed 4.1% compared to last year, which sounds great, until you consider the fact that CPI (government-reported inflation) is still at 3%. That number is actually much higher, which I’ve written about before. So spending is up, but wages are down to flat, which means Americans are spending more money on holiday trinkets. So where’s that money coming from?

The Debt Trap

Enter debt. American credit card debt is at an all-time high, with an eye-watering $1.23 trillion. Last year, Americans handed over $170 billion in credit card interest to the big banks. That number is expected to reach $250 billion by the time 2025 is finished.

In fact, early data suggests that upwards of 95% of Black Friday purchases were financed, either through a credit card or BNPL (buy now, pay later) like Klarna or Afterpay. Since almost 50% of Americans carry a balance from month to month, that hard-earned money goes from the lower “K” in the economy, directly to the very top.

It’s a stone-cold fact: Americans are spending money they don’t have. Sales through BNPL Klarna are up 45% YoY. PayPal BNPL is up 23%. Parents with children and consumers living paycheck to paycheck are more likely to use BNPL at 47% and 43%, respectively.

Key Takeaways on Black Friday 2025

Record Spending Doesn’t Mean a Healthy Economy — It Means a Desperate One

Black Friday “records” aren’t a sign of consumer strength. They’re a sign of consumers tapping out what’s left of their credit limits. When 95% of purchases are financed, it’s not a boom. It’s a warning.

Inflation Has Quietly Eaten the “Growth”

Retail sales up 4.1% sounds impressive, until you adjust for 3%+ inflation (likely higher in lived experience). In real terms, Americans aren’t buying more. They’re just paying more for less.

The Wealth Gap Is Fueling a K-Shaped Holiday Season

The top of the K is thriving, while the bottom is borrowing. Black Friday became the perfect visual: wealthy Americans shopped casually, while everyone else financed gifts they can’t afford to maintain the illusion of normalcy.

Personally, I’m going to spend this holiday season with my family. We’ll exchange a few small, meaningful gifts, but I’m not going to spend money on flashy things we don’t need. I hope every American joins in.

My controversial take? Americans didn’t overspend on Black Friday. They outsourced their pain in a time machine called debt. With 95% of this year’s holiday purchases financed, this season acts as a canary in a coal mine for a much larger crisis to come.

What do you think? Agree? Hard disagree? Sound off.

Jenny

P.S. Was this breakdown helpful? Make sure to forward it to colleagues and friends.

The Future of Shopping? AI + Actual Humans.

AI has changed how consumers shop by speeding up research. But one thing hasn’t changed: shoppers still trust people more than AI.

Levanta’s new Affiliate 3.0 Consumer Report reveals a major shift in how shoppers blend AI tools with human influence. Consumers use AI to explore options, but when it comes time to buy, they still turn to creators, communities, and real experiences to validate their decisions.

The data shows:

Only 10% of shoppers buy through AI-recommended links

87% discover products through creators, blogs, or communities they trust

Human sources like reviews and creators rank higher in trust than AI recommendations

The most effective brands are combining AI discovery with authentic human influence to drive measurable conversions.

Affiliate marketing isn’t being replaced by AI, it’s being amplified by it.

The Play of the Week: Roz Brewer, Former CEO of Walgreens

Roz grew up on the west side of Detroit as the youngest of five children, watching her parents work long shifts on the General Motors assembly line. From them, she learned two lessons that defined her path: education was the key to opportunity, and no role was beneath you if it moved you forward.

Years later, after becoming the first in her family to earn a college degree, she made a bold mid-career decision — going back to school at 40 to sharpen her leadership skills. That leap set the stage for her rise through Walmart, Starbucks, and Amazon, ultimately making her one of only two Black women to ever lead a Fortune 500 company.

The Execution Plan: Your Play for the Week

Instead of buying into the shopping frenzy, I challenge you to come up with a creative way to show a loved one you care this holiday season. Maybe you can do something nice for them like handling childcare for a few hours. Or maybe you can write them a thoughtful letter detailing how you feel about them.

The challenge is straightforward: don’t just buy them something.

Playmaker’s Spotlight: Real People, Real Wins

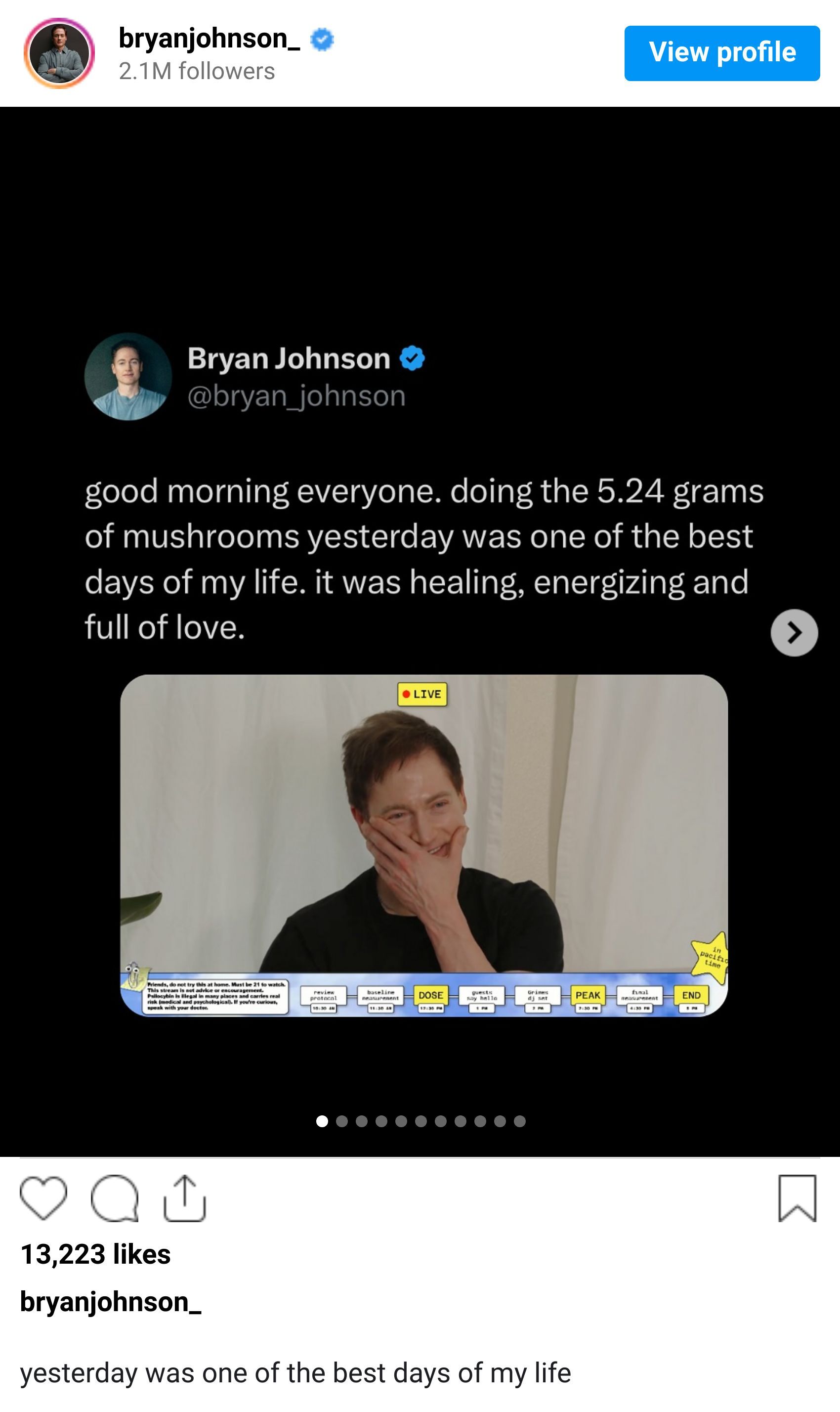

This week’s spotlight goes to none other than Bryan Johnson, Mr. Don’t Die himself. In case you missed it, Bryan made history this weekend by livestreaming a psilocybin experience. He was joined by a host of guests ranging from celebrities and CEOs like Grimes and Marc Benioff to personal guests like his dad and girlfriend.

In an era of “it’s all been done before”, Bryan found a way to bring a truly new experience to the Internet. As someone who has seen psychedelic treatment act as a miracle cure for my husband Pav (perhaps I’ll write more about that story another time), Bryan’s livestream was a joy to see. Check it out for a smile.

Want to be featured next?

Make sure to tag @Jenny Stojkovic on your post for a chance to be featured.

The Extra Edge: Some Techie Stuff I Love

☕️ Want to have virtual coffee with me?

I’d love your help spreading the word about The Wednesday Play. Refer other people to the newsletter and get free time with me for a video call.

How to Get Involved:

The Wednesday Play isn’t just a newsletter — it’s a community. I’ll be announcing much more in coming weeks and months! For now, let’s connect across social.