Hi Playmakers,

November is Long Term Care Awareness Month, so it’s the perfect time for us to have this conversation…

A close friend of mine has a unique profession. She’s a death doula— helping people and families navigate end-of-life care, planning, and passing from this world into the next. It’s an exceptionally kind & noble line of work, and one that will become more and more common as our population ages.

It’s a difficult topic for us all. So much so, that many people avoid planning for the inevitable altogether. Her and I got to talking about our aging population, the skyrocketing cost of care, and how an alarming amount of baby boomers are not financially prepared for retirement and end of life. She dives into The Storm Coming for Our Elders in her latest piece.

Recently, when I wrote about The She-cession and why women were leaving the workforce because of rising childcare costs, many of you reached out to tell me about the rising costs you were experiencing with taking care of aging relatives.

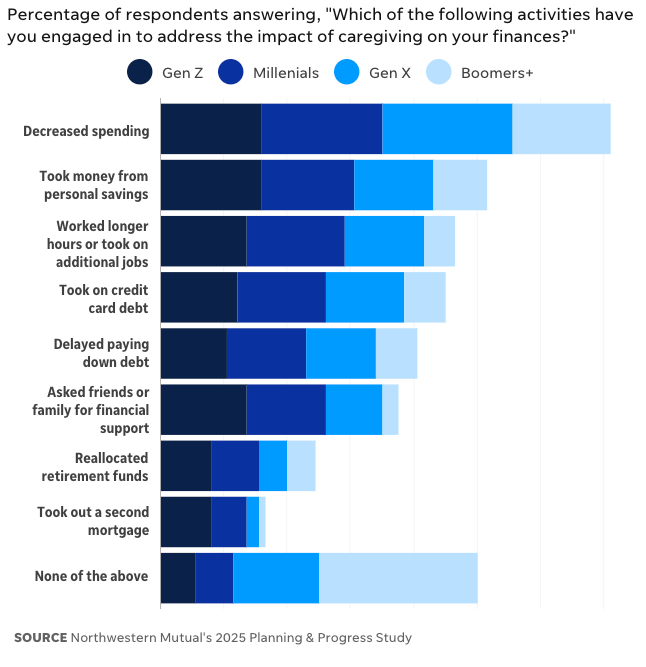

Enter the Sandwich Generation. Let me put it out there bluntly— younger generations are taking on a growing financial burden for caretaking compared to previous generations, all while caring for children and balancing their careers.

In fact, one in four Americans now belong to the Sandwich Generation, representing 23% of the workforce. This number is expected to grow as the large Baby Boomer population continues to age, while younger generations are having less children. This means less working adults supporting a large aging population.

It’s a difficult problem to solve on a macro scale. Healthcare costs are skyrocketing, and it can be difficult to make up for decades of poor financial planning, but here are the steps my husband and I are taking with our parents to make sure everyone is prepared and on the same page:

Signal that you want to have the conversation, then set a time and place to actually have it. The worst thing you can do is catch a loved one by surprise. Death is a difficult topic, and discussing finance will make anyone feel vulnerable. If a parent refuses to have the conversation, let them know that your intention is to plan now so you can enjoy your time together and avoid any future arguments or frustrations.

Set clear boundaries and parameters. Once you bring everyone together to have the conversation, be clear about what you can and cannot support. Avoid sentences like “I won’t do X.” Instead, consider open-ended questions like “Do you have a will?” or “Have you thought about where you want to live and who will take care of you?” You may not like the initial answers, but it’s better to have clarity so you can get on the same page.

Understand your own financial situation. Y’all know I’m a fan of mastering your own finances. I’m not only talking about the basics of planning for your own retirement. I’m talking about scoping out worst-case scenarios. “If dad is gone and mom gets sick, what can we afford? How long can we afford it for?” Planning for worst-case scenarios is a painful exercise, but it’ll help you understand what is or isn’t possible if and when the time comes.

Understand their financial picture. I know. This might be the hardest one to tackle. It’s hard to get a parent or loved one to be completely vulnerable about their finances. Take this one step by step, and see how far you can get. For me, red flags can be phrases like “don’t worry about it” or “we’ll figure something out.” Hope and ignorance are not strategies. Instead, ask: “I want to know how much you’re spending, and how long you can sustain a particular lifestyle. If a loved one gets sick, what options are available? Do you have life insurance?”

Look, I get it. None of these steps are silver bullets. We live in a complex world of inflating prices, unsustainable Social Security, and a dwindling safety net. But the reality is, every day you wait on this issue is a day too late: 58% of Americans are going into debt to take care of their aging parents, and 46% of Americans resent their parents for putting them in this situation.

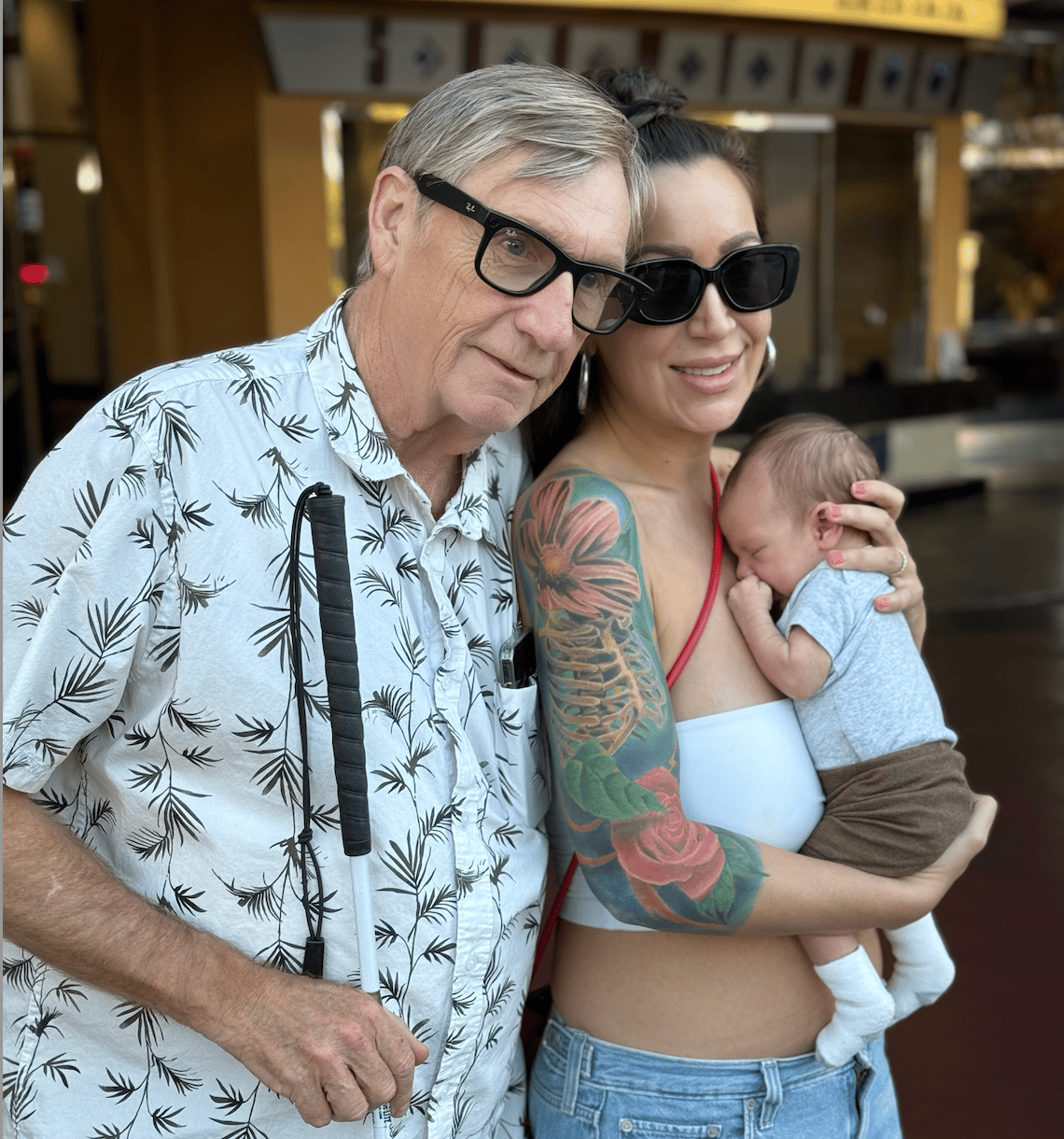

For me, growing up with a blind father, this topic has been top-of-mind since I was a child. When a parent is permanently disabled, you must have difficult conversations much sooner than other families. Contingency plans for care are not optional. Meanwhile, my husband and his family come from an Eastern European culture, where death and finances are taboo discussion points. Regardless of your family situation, we can all benefit from having clarity and planning sooner rather than later.

My dad, my son Roman, and me!

If we’re going to embrace being the Sandwich Generation, we need to take hold of the things we can control so we’re not completely blindsided by the things we can’t.

I’d love to hear from all of you. Are you dealing with these anxieties in your life? What are you doing to plan for your future and for those you love?

Let me know (as always, tag me on LinkedIn, so I can reply).

Jenny

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.

The Play of the Week: Christina Cacioppo, Founder and CEO of Vanta

Christina grew up in Ohio as the daughter of first-generation immigrant parents, selling Beanie Babies as her first business and discovering a love for building things from scratch.

Years later, after stints at Stanford, Union Square Ventures, and Dropbox, she turned that same entrepreneurial curiosity into a $1.6 billion company by founding Vanta — helping thousands of startups earn customer trust through automated security and compliance.

The Execution Plan: Your Play for the Week

This week, let’s have a hard conversation.

Since we’re already covering difficult topics and difficult conversations, let’s keep this theme going.

This week’s challenge: Have a difficult conversation you’ve been putting off.

If you’re putting off a tough topic with someone, you’re only doing them and yourself a disservice by putting it off. Yes, sometimes you might make the other person upset. Yes, it’s uncomfortable. It’s time to muster up the courage and have the tough talk you’ve been putting off.

Playmaker’s Spotlight: Real People, Real Wins

This week’s spotlight features the OG queen herself, Paris Hilton. In case you haven’t been paying attention, Paris has come a long way from her reality tv days. In fact, she is now the highest-paid DJ in the world and is CEO of her own media empire.

Her recent endeavors to build in public have shone a light on ADHD in business. This viral clip below showcased how she has re-organized her office around her ADHD tendencies. From one ADHD gal to another, I approve.

Want to be featured next?

Make sure to tag @Jenny Stojkovic on your post for a chance to be featured.

The Extra Edge: Some Techie Stuff I Love

👉🏼 With how fast AI is changing, I’m revisiting Ray Kurzweil’s work. The Singularity is Near, and the recent add-on, The Singularity is Nearer, are must-reads for anyone interested in technology’s acceleration. |

👉🏼 I’ve been using HighLevel to build my business, website, and CRM. It’s been a game-changer for me. |

👉🏼 Trying to create content while nursing is easier when I can use AI tools like Opus Clip to edit quickly. |

☕️ Want to have virtual coffee with me?

I’d love your help spreading the word about The Wednesday Play. Refer other people to the newsletter and get free time with me for a video call.

How to Get Involved:

The Wednesday Play isn’t just a newsletter — it’s a community. I’ll be announcing much more in coming weeks and months! For now, let’s connect across social.