Hi Playmakers,

I don’t talk about money because I care about money itself. I care about having freedom, and I want to pass my mindset on to as many people as I possibly can.

I believe buying our first home was one of the best early financial decisions my husband and I made. We spent every penny of our savings for the down payment, allowing us to start building wealth early, as well as set the foundation for our nest egg.

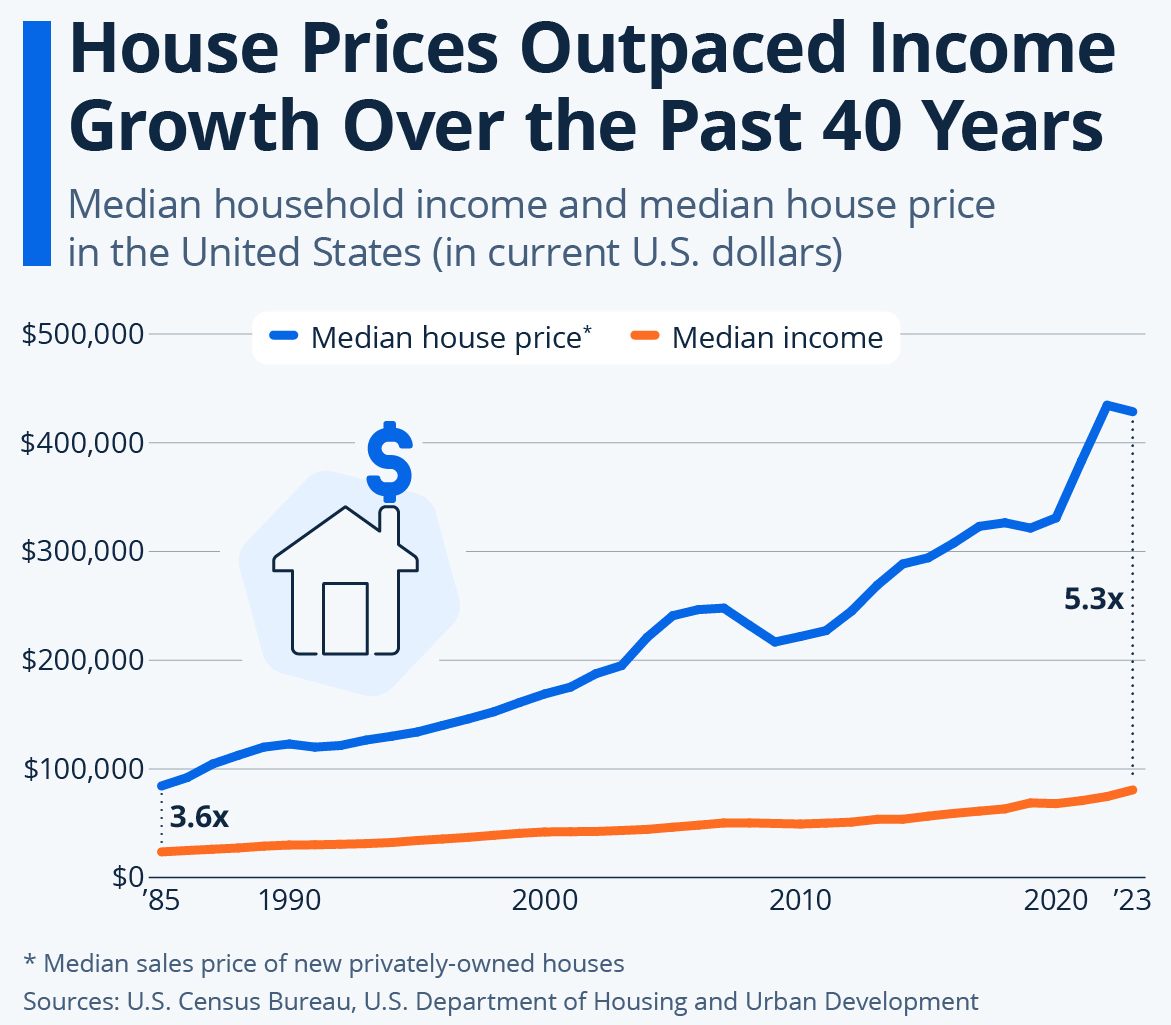

It’s no secret that Millennials and Gen Z are finding it increasingly out of reach to own assets, especially housing. No, it’s not because of avocado toast and Starbucks coffee. This holiday season, you can finally school that one uncle with the data— housing prices have significantly outpaced median wages, making it increasingly difficult for younger generations to own their first home.

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.

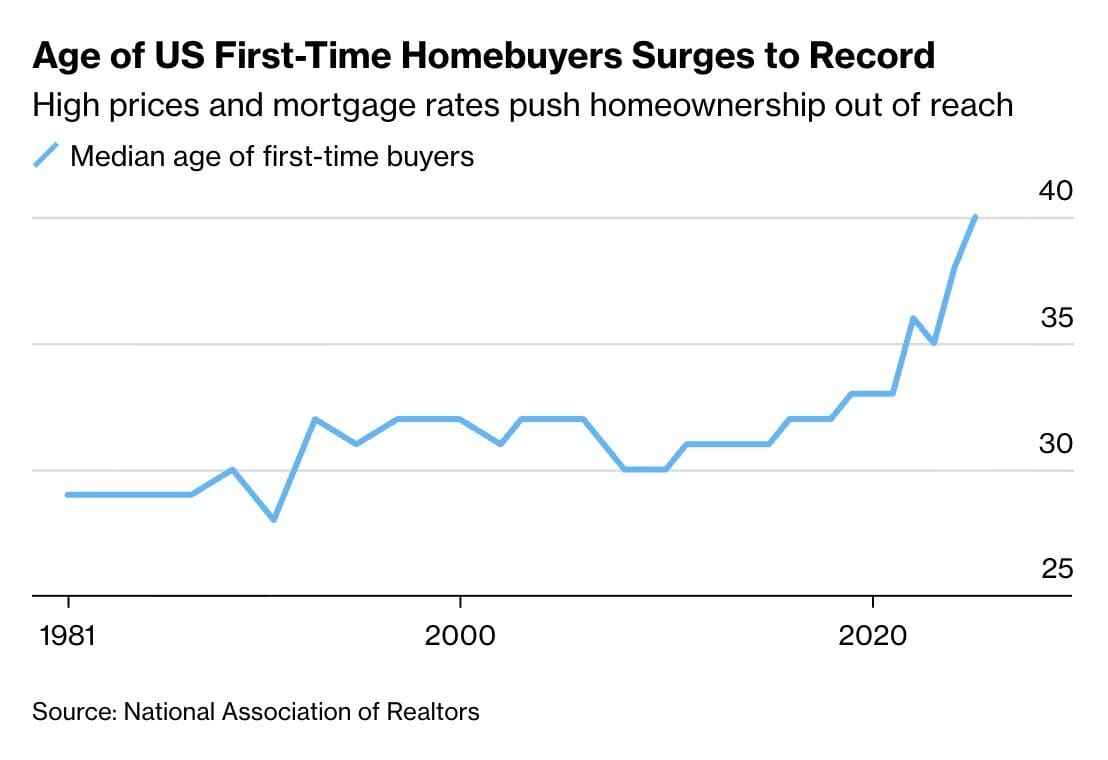

In fact, housing is now so expensive, the median age of first time homebuyers has surged to a record high of 40 years old. Enter President Trump, who this week announced his intention to introduce a 50 year mortgage. The idea is that giving young buyers a longer window to pay a mortgage would make it easier for people to buy a home.

But does a 50 year mortgage actually help? Let’s try and look at this objectively to see if a 50 year loan can actually help my generation. Hope you’re ready for a lot of numbers…

The Bad

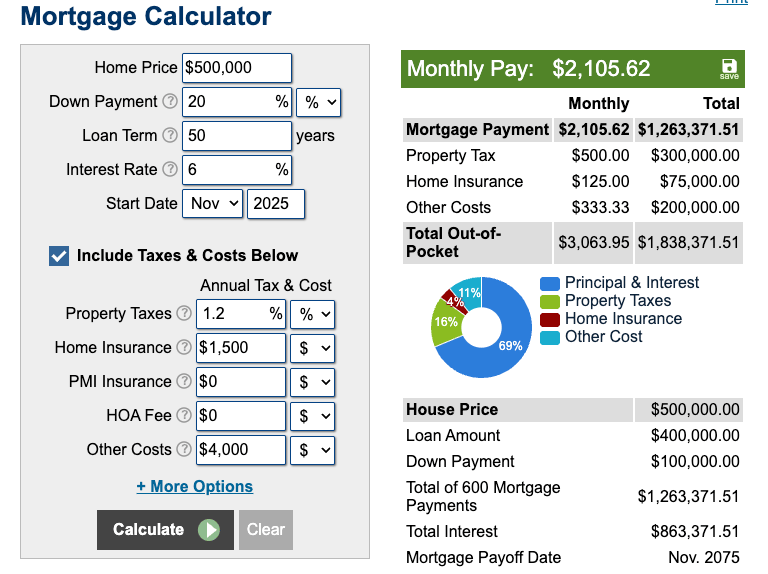

Well for starters, for most people, the issue is the down payment, so an extended mortgage won’t help you at all. But let’s be generous and say you have the money to cough up for a $500,000 home (about the median cost in the US.) I also included some conservative costs for things like home insurance, property taxes, and general maintenance.

Here’s what a 50 year mortgage looks like:

Yeah… your interest payments alone are over $860,000. In fact, because of how loans are structured, your almost entirely paying interest and add almost no equity into your home for the first 20 years. To put it bluntly, 50 year mortgages are a great way to extract wealth from younger generations and hand that money over to the banks.

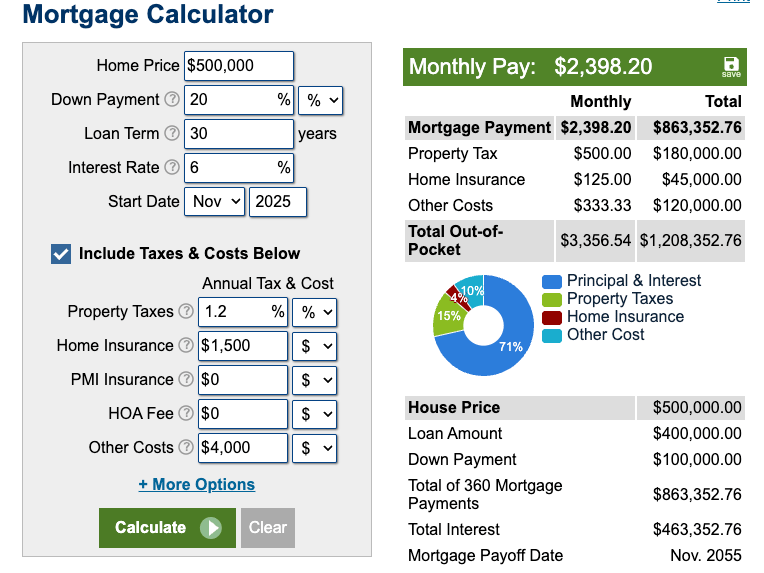

And yes, a conventional 30 year mortgage is MUCH better:

$400,000 less interest over the course of the loan. Again, I’m being conservative here. A 50 year loan will certainly carry a higher interest rate (30 year loans come with higher rates than 15 year loans.) If you can’t put down 20%, you’ll have to pay PMI (private mortgage insurance) and HOA fees if you’re buying a property that’s part of a community.

The Good

So what’s the upside? Well, debt can be a good thing if you know how to use it well and you’re looking at the right time horizons.

For starters, a 50 year mortgage shaves $200 off your monthly payment. If you’re more concerned with cash flow instead of building equity, this is one minor upside.

But here’s the big one I think about when I look at debt. Fixed, long-term debt is a fantastic inflation ledge. You are effectively shorting the dollar. Here’s what I mean: the value of the dollar consistently drops over time through money printing (inflation), something I’ve talked about before.

That means the burden of your loan decreases over time. So the question is, do I expect my wages, my other investments, or my business to keep pace with or exceed inflation? If yes, then fixed long-term debt is a great way to put money to use elsewhere.

To put it simply, a 50 year mortgage gets easier to pay as the years go by, allowing the math to work in your favor on the backend.

Still with me? In my opinion, for most people, a 50 year mortgage is highway robbery. Unless you’re ready to stay in a home for 50 years, you’re effectively giving your money away to the banks.

So here’s my perhaps controversial take: young people are better off renting.

Seriously. You aren’t locked down for 50 years. You’ll have a more modest monthly payment, and most importantly, you can take the extra money and invest it in the stock market.

Do you agree or disagree? Sound off.

Jenny

The Play of the Week: Toni Ko, Founder of NYX Cosmetics

Toni grew up in Los Angeles after immigrating from South Korea at 13, spending her teenage years working in her parents’ small cosmetics shop and learning exactly how women shopped for beauty products.

Years later, she turned that early experience into NYX Cosmetics — creating high-quality, affordable makeup that bridged the gap between luxury and accessibility. In 2014, she made history when L’Oréal acquired her company for $500 million, making her one of the first immigrant women in America to achieve such a milestone.

The Execution Plan: Your Play for the Week

Since we’re already talking about numbers, let’s keep the ball rolling into this week’s challenge.

This week’s challenge: Find a way to save an extra $25 a week and invest it in the stock market.

Here’s the good news. In many cases, you don’t even have to buy a whole share of a stock or ETF. Investing in your future is easier than ever. The most important lesson? Get off zero.

Playmaker’s Spotlight: Real People, Real Wins

This week’s spotlight goes to the ultimate biz builder, Greg Isenberg.

If you aren’t following Greg already, you’re in for a treat. He’s got all the entrepreneurial insight and expertise you need to get started.

Want to be featured next?

Make sure to tag @Jenny Stojkovic on your post for a chance to be featured.

The Extra Edge: Some Techie Stuff I Love

☕️ Want to have virtual coffee with me?

I’d love your help spreading the word about The Wednesday Play. Refer other people to the newsletter and get free time with me for a video call.

How to Get Involved:

The Wednesday Play isn’t just a newsletter — it’s a community. I’ll be announcing much more in coming weeks and months! For now, let’s connect across social.